2024-11-8 00:35:35 Author: hackernoon.com(查看原文) 阅读量:2 收藏

Yesterday I glimpsed AI in Five, Fifty and Five Hundred Years — Part Three — Five Hundred Years by Daniel Jeffries, and today I remembered that the Opt-Out Writing Contest had a #Reputation tag on it.

I soon had the idea for this article.

A tale on the far future of reputation networks.

A blockchain can get really huge

Imagine this.

500 years from now.

The Bitcoin blockchain, which keeps growing linearly at 2MB every 10 minutes (conservative estimates putting aside L2 and L3 data, plus database indices), will be some 53 TB in size.

That is huge.

Kinda.

But while Bitcoin is growing linearly, the internet is growing exponentially at a rate of 3% per year. Meaning it will be doubling every 34 years. At about 170 trillion GB today, in 500 years, the internet will have grown to 2550 trillion GB.

However, blockchain technology as a whole (led by Bitcoin) is growing way faster than the internet, with an 82% CAGR projected over the next 8 years to 2032.

Here’s the maths: If this growth is sustained for 500 years, this will be tripling about every 3 years. That is 166 triplings. This translates into a blockchain market with ~ 1 billion billion billion billion billion billion billion billion GB in size.

Now that is huge.

So will Blockchain alone, with all the data of who owns what, narratives on how valuable it is and more, be all those billions of times bigger than the internet?

Where shall we be keeping it?

Obviously, it will crunch to a halt way before, collapsing into digital oblivion.

Or, 100 years from today, way before the last bitcoins have been mined, somebody, some people, or some Black Swan event will reset the Bitcoin blockchain.

What are we resetting, though?

All that data. All that money.

Is Money Trust Inscribed?

Cryptocurrency could as well be renamed ‘The Great Money Test’, for it is a nascent way to stress-test the simplest and most critical definition of money for our day and age.

The definition that says; ‘Money is trust inscribed’ - Niall Ferguson, The Ascent of Money.

What does that statement mean?

Abstractly put, money is you trusting some words written on something (trust inscribed), so that if you take those words to the market, they will return anything worth what they say they are worth! (because other people also trust those words).

Imo, it is the closest thing to magic we humans have invented. Not electricity, not the internet, not Starship rockets. Money.

Here is a metaphorical story for that abstraction.

Imagine a dude named Sam picks up a leaf. He writes the words ‘Worth $100. Payable by Sam’ on it with a marker.

You trust this leaf. Because you trust Sam.

Why? Why the hell do you trust Sam?

That is the question.

Assume Sam is a genie and he always honours his word.

Well, there you have it.

You can now use that leaf to buy a $100 smartphone and nobody would bicker. Because they trust Sam too.

Sam does things like this all the time, and he really pays back these people anything they want, worth $100.

If this works for years and nobody complains about Sam on Reddit, then Sam really is some sort of genie.

And these leaves are his magic travelling through your transfer actions. Quietly. Invisibly.

Alas, this is the real world.

Sam is called Uncle Sam and people complain ALL THE TIME about his cotton-based leaves on Reddit, X and all over the internet.

Why? Why do they still trust Sam?

Give a benefit of the doubt. This is real life. Patience is key with real magic.

But still, he hasn’t paid a lot of them back those 100s of dollars that he gave other people to spend in their stores.

And one way or another, all those people in Uncle Sam’s country have all eaten a lunch on loan, and they want Sam to pay for it.

No, they don’t want to pay for it themselves. They were told Uncle Sam will pay for it all, so he has to pay for it.

It’s also been too many lunches. Nobody wants to think about them.

Meanwhile, they want more free things like Universal Basic Income. More magic wishes please.

Sam isn’t worried, though. There is some sort of record of his debt obligations, now climbing to $35 trillion. But he has democratic elections ongoing to get the best people in the right places, and he can see a future where his territory will be worth many more quadrillions of dollars.

He just has to find a way to get AI, Big Data, Rocketry, Blockchain, etc digging out those golden opportunities, and keeping the trust inscribed.

The trust must remain inscribed.

Otherwise, if people stop believing that Sam has those financial superpowers, they’ll go ape-shit.

Then the Bear or the Panda will take over the cotton jungle.

Not good.

***

Now Cryptocurrency, a mainstream blockchain use case, is an interesting technology.

It says it is better at keeping trust inscribed than Uncle Sam.

Good but not good. Because it means Sam has to allow alternative records of money and debt obligations to exist, controllable by no humans at all.

Not even the elected officials!

‘Bull!’, cries Sam. But he cannot stop encrypted messages from travelling wherever they please.

He’s getting around to it these days, though.

Crypto wants Uncle Sam to admit the truth. That he is no genie and having a select group of people as the guardians of the cotton-based-paper-leaf money is not the best way to do this money business.

That pure energy alone can keep a record of financial transfer actions (transactions), and people should stop trusting in the great might of Uncle Sam and his paper-leaf money, because it cannot keep trust inscribed for long enough.

Papers rot, and some of those officials have the power to change them on a whim.

People might thus be better off trusting the exchange of monetary hash strings inside a great, highly incorruptible energy-guzzling behemoth, that uses ever more computers to check the same things, the same transactions + 1, over and over again each time they move those hash string monies around.

‘But this will break the networks of trust we have formed!’ cries Uncle Sam.

‘Don’t you see? Nobody is going to get a respectable loan from another person across this “energetic checking system” because they don’t trust the anonymous person on the other end of the crypto call to do them right. They don’t know them.’

‘And wrong strings can be sent, scammers could be listening to this call, and I personally cannot protect these people, because they are going against me through little known trade routes.

A lot of people will be scammed. Hell, this could even be one big scamming machine posing as an open-source money-management genie (FTX)’.

The people, call them cypherpunks, who built these things, listen intently to Sam’s valid points. They are smart people who care-less about cosmetic lies like that leaf-money jazz. Maybe it makes life easy, but Uncle Sam’s people have been developing outsized egos and thick heads of recent. Call it Printer affluenza.

They think hard, the conclusion is imminent.

‘Yes. You’re right. Money won’t be trust inscribed anymore like in your one-money system. Inherited from the Ancients themselves.

But if money really is trust inscribed, then this is its greatest stress test yet. Because we inscribe every transaction.

Hope we learn to find even more trust in these quasi-random-networking systems called cryptocurrency. Cobbled together over phone screen, without much human touch, smell, or reading of body language like in the hierarchical systems of fiat.

Hope we learn to be trustworthy, good human beings. Even if the person on the other end of the call has no clue who we are’.

‘Why, because the system, by itself, is built on trust inscribed as often as possible’.

Sam is stressed and wishes he could slap the cypherpunks. But they are online.

He is pissed off to hell and back.

He has to sit this experiment out. Like everybody else.

Come Rain or High Water, Hurricanes or Energy crisis, this experiment must be seen through.

So everybody should just take a breath and take it easy.

Violence ain’t going to bury a technology now out in the light.

What’s worse, AI makes booting up any alternative cryptocurrency technology as easy as following a cake recipe. No more need for a PhD in computer science like the OG cypherpunks.

Two Futures of Trust Inscribed

There are many definitions of what money is.

But I hope you’re sold on Money is Trust Inscribed.

People want a trust-based currency. Be that trust from some clever and energetic computational system (called Bitcoin), or from the word of a big powerful government.

Now what will determine whether the trust is from a big powerful government or from Bitcoin?

Well, two paths of human history.

1 - Bitcoin proves to be easier to trust than Big Government

This could be because AI improves blockchain rails, or the energy crisis turns out to be a scam we can all harmlessly forget. It could also be because we get to have a period of unparalleled peace, going to Mars and being cool like Elon Musk.

Governments will try their own cryptocurrency experiments just to blend in with the good guys, but everybody will know that BTC runs the party. The world will likely be a better place. Government leaders will be authentic and will be loved by their communities.

In What will Bitcoin look like in 20 years? Daniel Jeffries argues for the flourishing of government cryptocurrencies. But the term ‘government cryptocurrency’ is a misnomer. Governments have a need for cryptography, yes. To keep secret documents secret so that innocent people do not get hurt. But definitely no need for secret money (that’s like hiding a throne under the ground), nor to check their transactions’ history records in a computational cycle that wastes time and energy and storage space.

You might be saying CBDCs (Central Bank Digital Currencies) under your breath. They are not real cryptocurrencies. It’s a sham to make the governments look progressive and cool, but they might as well have just called it ‘good old digital money with a new name’. The only new thing will be all the AI use cases that will be embedded.

Government digital currencies will flourish, yes. Because governments are financially powerful institutions that can hold their own better than most crypto startup bros. But they will not be cryptocurrencies. They will be databases with passwords provided by the NSA, and a lot of armed guards at the front door.

And if Bitcoin suffers some sort of set back because of a volcanic eruption, an asteroid impact, or maybe it is hijacked by a cabal of new-mafia-kid-on-the-block cypherpunks, I bet, governments could even try to help it survive.

You know, like Tom helps Jerry when a bad dog shows up.

Yes, they are enemies. But we all need to eat and keep making the world a better place.

2 - Government trust proves easier than trusting in autonomous energy systems

Flip the script on its head, and Bitcoin fast becomes useless.

For starters, imagine some sort of AI menace is invented to hijack cryptocurrency rails. Like some sort of blockchain Terminator.

That would be bad and I hope Arnold Schwarzenegger will be back.

Even worse, the energy crisis and its cousin climate change actually get on with their destruction program, then we are kinda doomed.

In such a world, electricity would be unreliable and very expensive, and using it to run and re-run transaction hashes from hundreds of years ago because “documentation” or “genesis block” would be frowned upon as a waste of time and money.

Endless wars are another way to go down this dark path. That’s why I hope the new POTUS will help the world find its way back to peace. With a surer resolution of the armed conflicts around us than their predecessors.

Bottom line:

‘Our grandparents are the reason we are in this mess’. ‘Burn their blockchain history!!’

Sad but possible. For in times of massive socio-economic and socio-political reset, people usually destroy the past. Because it created their hell.

In such a world, allying with real humans that one knows physically is a surer bet for success.

Trust here is better inscribed in emergency-mode government hierarchies, which emerge to guide various societies through the quagmire of war, energy crisis, food crisis, or AI crisis.

Fiat money, cold, hard, and real, makes all the sense in the world. Because the trusted leader gave it to me.

Also, AI cannot steal cold hard cash unless it is Optimus. In which case we’ll blow it up with our guns.

Bitcoin from some anonymous person online? Might be terrorists setting up bait. Terrorist AI created by the ongoing hell of the time.

Bitcoin is pseudonymous though, so we can know them.

In a Bitcoin apocalypse, if you met people on the street and said ‘Hi’ to them they’d likely have no kind word.

Famine has struck the land. Why would anybody smile at you when all they want is to eat you?

But the famine is the initial problem. Not the person wanting to eat you.

That’s why whoever argues against people and never causal events needs to try and think. Also, the pursuit of quarks and all manner of esoteric particles in high-level Physics should be paused imo (no wonder they gave the Nobel Prize in Physics to AI). We need to solve the energy crisis, dear anon Physicist.

Dark matter and Strings will not go anywhere. Let’s solve the problems that matter, then go back to pondering the origins of nature.

Let’s come back to those children. Burning the genesis block.

Burning priceless art.

Burning the Mona Lisa.

Burning … burning.

Why, oh why.

Reputation.

A bad reputation on the blockchain.

Left behind by their grandparents who just wanted to “mind their own business exploring dark matter, meme jpegs, ponzi schemes and pseudoscience”.

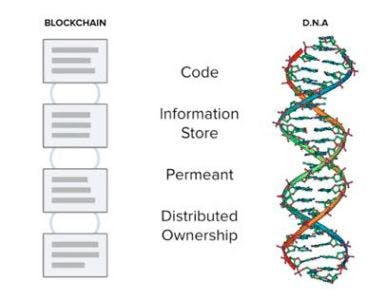

Reputation DNA

Bitcoin is a 3-dimensional financial technology.

1 - It is soft money, like Paypal dollars. This is if you use the Lightning network.

2 - It is hard money, like gold. So it only goes up in value over time. Lest the above crises in which case everything will fall in value.

3 - It is a decentralized, immutable narrative record, like Wikipedia but you can’t easily edit by removing information. But you can easily add information to it if you pay the gas.

Now what does 3 above remind you of?

A record of information that is hard to change. That evolves as it adds new information.

A record of information where one strand encodes everything about a human being, just like one copy of Bitcoin core encodes the entire Bitcoin network.

DNA.

The blockchain will evolve to be Reputation DNA.

Why Reputation DNA is easy to see. Hard forks look like DNA splicing, MEV is gene editing, and multi-chain projects is recombinant DNA. Or haploid-stuff during the formation of a zygote.

Bitcoin has the best Reputation DNA given its long chain with relatively the least tampering in its 15 years of life.

Its reputation chain starts with Satoshi Nakamoto, the genius inventor who kickstarted the growth of this reputation tree, and left.

Soon, the Bitcoin blockchain is going to develop communities of trust based on the reputation of the people in its ecosystem and the transactions they make.

Right now, NOT transacting is all the rage. They call it HODLING and it is a big deal if you have diamond hands.

But after a while, it will become exhausting to keep chanting “To the moon” and “WAGMI”. So those who have arrived somewhere in the space will feel compelled to start their own communities, running on their gains to create more real value as a way to give back.

Maybe they will start a repair shop or a crypto recovery shop (I respect these kinds of chops).

But what will their underlings base on to respect them?

That’s right. The immutable truth of the Blockchain. The truth showing that these guys actually held and DCA’d for decades. They did not happen to have an uncle working for the Fed.

Truth of hard work breeds the surest trust. And with that kind of trust, humans can conquer the biggest things.

The same goes for the Ethereum, Solana, and other crypto communities. There, reputation could be best measured in the unwavering dedication to commit valuable code to the ecosystem.

Should Physicists and others building truly epic stuff, document it on the blockchain?

EXACTLY. That’s why it exists.

For us all to see and be inspired. So that if I run a TB of the blockchain I do not find generic-ish like multiple PEPEs or WOJAKs but some truly inspirational stuff. Stuff worth running a lot of electricity on every second.

And.

It doesn’t stop there.

50 years from now. This reputation will be passed on to the children of the blockchain heroes. 100 years from now, the grandchildren.

More hundreds of years, and the Bitcoin blockchain will be a reputation record with the best of humanity inscribed.

With the reasons to trust in human goodness laid out, remixed once in a while, but kept intact.

The Bitcoin blockchain at this point will likely be so big and attractive it will be the Metaverse we all dreamt of not so long ago.

Many will gladly risk their lives going to explore and break ground on other planets, for a chance at extending the best narratives of the blockchain’s inscriptions.

Even governments could inscribe their best deals. Why not. Why only inscribe catching terrorists like in the Silk Road incident?

On the flip side, when war comes, this record will serve as a reminder that we should not lose hope.

It might fail at its task, but it will try.

For all our reputations will be encoded there.

Reputations of billions of us, across centuries.

Reputations passed on to us by people who fought and bled to give us a great world.

Come Rain or High water, Hurricanes or Energy Crisis, we shall have a legacy to uphold.

如有侵权请联系:admin#unsafe.sh