2024-6-18 20:49:48 Author: hackernoon.com(查看原文) 阅读量:4 收藏

Many of you have probably heard about the unique opportunities that Central Bank Digital Currencies (CBDCs) will bring, such as programmable money, smart contracts, and seamless cross-border transfers. In this article, I will delve deeper into these features and show how they can transform the user experience through a real application interface.

In a previous article, I explained what CBDCs are and described the basic functions of a CBDC application, which is already operational in several countries in Southeast Asia and Oceania. Now, I will present the interfaces of the advanced version of this application. Some of these features are already available, while others are in prototype stages or under development.

1. Programmable money

Thanks to blockchain and smart contracts, we can customize each digital dollar (euro, or yuan). This means we can decide who can spend it, what it can be spent on, and even set time limits or other detailed rules.

Targeted money

This is money with a defined purpose. Using CBDC will make these types of transactions much easier for both the sender and the recipient. These features can be built right into the basic CBDC payment app.

Case 1: Receiving and spending targeted money

Within the application, targeted money appears like another account with descriptions of the categories it can be used for. For instance, this could be a subsidy for utility bills. In many countries, utilities make up a significant portion of household expenses, and targeted assistance for these bills can greatly improve people's quality of life without adjusting tariffs or implementing complex subsidy procedures.

CBDC and targeted money provide a straightforward and effective way to manage this kind of assistance. By simply identifying those in need and transferring the funds to them, the money can be restricted for use only on specific expenses like water, electricity, and internet.

The process is quite simple: the application ensures that funds from these accounts can only be spent with accredited suppliers of utilities. Otherwise, all other functions work just like any other transaction.

Case 2: Sending targeted money to someone

You can enhance the CBDC application with a feature that lets users set conditions on how the money they send can be spent. For instance, when donating to a charity for homeless animals, you could ensure the funds are only usable at pet product stores. Or, if you're paying a construction crew, you can specify that the money is restricted to purchases at building material stores. Think of it like a more flexible and convenient version of gift certificates.

Case 3: Receiving and using money with an expiration date

This tool is great for quickly distributing "helicopter money." The government can take swift action to support the population and economy by providing large subsidies for everyday purchases while preventing the money from being saved instead of spent.

In the app, another account appears with a time limit after which the account will close. The money can be spent on any goods and services, but it can't be used to buy foreign currency, transferred to others, or withdrawn to a bank account. As the expiration date approaches, the app will send notifications to remind users to spend the remaining balance. The payment process is almost the same as usual – just choose the priority account for payment.

Case 4: Transferring large sums of money with a timeout

To protect people from scammers and robbers, you can implement a mandatory delay when transferring large amounts between users. With this feature, if a user sends a significant amount of money to another user (above a certain limit), the recipient won't be able to access it until a set period of time has passed (for example, several hours or a day). This gives the sender time to freeze the transaction by contacting law enforcement, which can be done directly through the app or by notifying any police officer.

Limit management can be adjusted flexibly. For instance, limits can be increased or decreased based on the recipient user's average turnover and account age. Or, the limit can be raised after the sender completes online financial literacy courses. All of this can be done automatically without human intervention or opaque selective transaction verification algorithms.

There are also other ways to program money. For instance, you could restrict it to being spent only in a certain region, or prevent it from being split into smaller payments, requiring it to be used all at once, and more.

2. P2P Lending using smart contracts

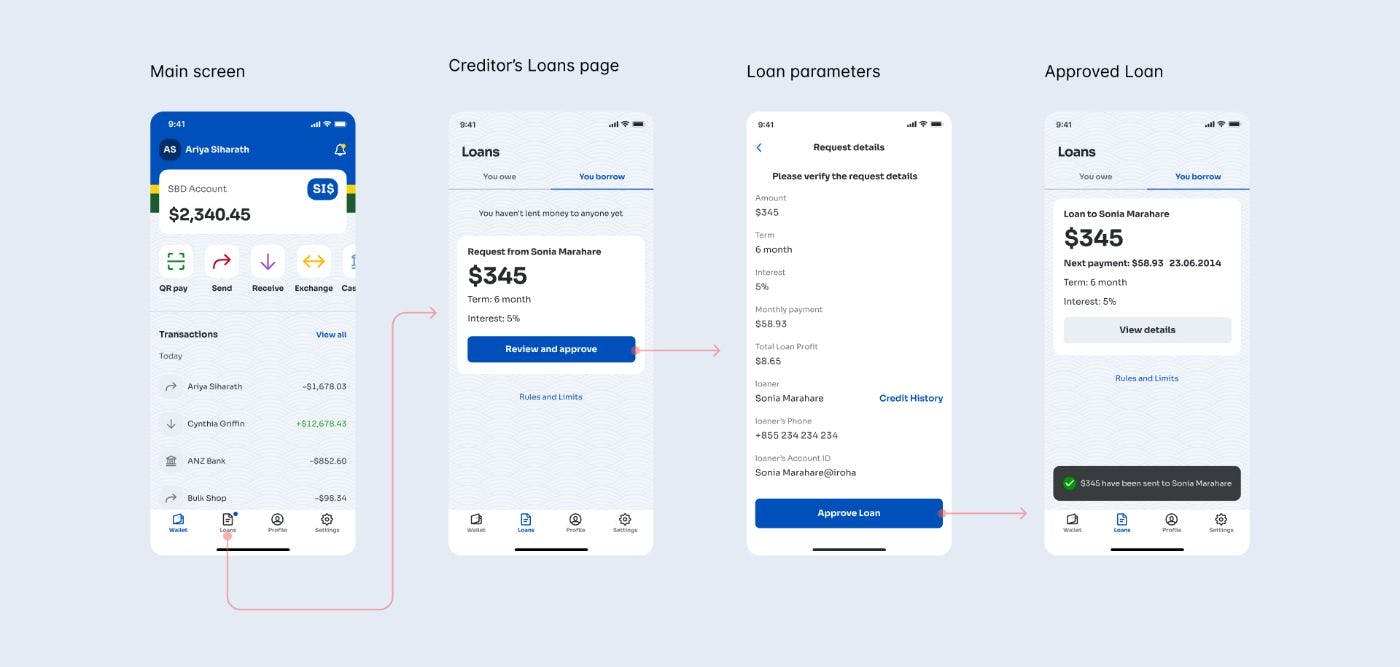

The second option available in the CBDC application is a unique feature that allows users to lend to each other against future funds in their accounts. One user can request money from another user, agreeing on specific repayment terms. Once the agreement is made, a smart contract ensures these terms are automatically followed, with payments being prioritized from the borrower's main account.

The central bank regulates the conditions for such loans, including possible interest rates and terms. When requesting a loan, users can share details about their account's history and average monthly transactions with the potential lender, along with any available credit history. Since each person can only have one unique CBDC account, which cannot be closed and replaced, this offers a strong guarantee of repayment. The CBDC account itself acts as collateral for the loan.

In the interface demonstration, we've implemented the basic microloan feature that replaces traditional IOUs. However, the technology has the potential to expand p2p lending to a level where it could compete with traditional banks. By adding credit rating calculations and creating an impersonal exchange for issuing and borrowing loans, users could lend and borrow without paying commissions to commercial banks.

With CBDC, citizens can more effectively invest their savings in bonds. By using digital money and retail applications, they can do this directly, without needing banks or other intermediaries. All transactions will be securely stored on a private blockchain, and bond trading will be automated through smart contracts. This means citizens can earn more from their investments compared to traditional bank deposits, while the central bank can attract more funds at lower interest rates by cutting out the middlemen.

For this purpose, an adjacent CBDC application can be created, featuring a separate investment account where users can transfer money for bond investments. Within this application, users can buy and sell bonds on an automated exchange and participate in new bond issues by placing orders in advance. Coupons and profits are credited here and can be easily transferred to their regular accounts.

To protect users, trading limits can be set based on their income and experience, with opportunities to increase these limits after a certain number of transactions or by passing certain tests.

4. Smart Contracts

Using CBDC can significantly streamline and secure transactions involving registered property like real estate and vehicles through smart contracts. The buyer and seller can sign a contract within the application, which is then automatically executed, ensuring the seller receives payment and the buyer's ownership is registered in the state database. To further protect both parties, the transaction can require certification by a third party, a waiting period, or confirmation at a government office.

For instance, when buying a car, the process could look like this: the buyer scans the car's license plates and sends a request for full information via the app. The seller receives this request and consents to the data transfer. The buyer then sets the contract terms and signs it, which blocks the transaction amount in their account. The seller, seeing the contract at home, signs it, and the car is then blocked in the registry.

Depending on the transaction amount, the contract is executed immediately or after an additional condition is met, such as a waiting period or third-party confirmation (from a notary or government official). There’s no need to manually check documents or ensure money transfer, just verify that both parties understand and agree to the terms. The electronic signature of the certifying official is stored in the registry for audit purposes.

This is just one example of using smart contracts. More complex scenarios can be implemented, such as employment contracts with automatic salary payments from the company’s CBDC account, property-secured loans, shared accounts requiring multiple signatures, and more.

5. Cross-border transfers

For international transactions, CBDC can introduce a new mechanism for cross-border transfers. Here’s the main idea: a user opens an account in the CBDC application of the destination country and exchanges their digital dollars (or another currency) from their home account to digital pounds (or another currency) in the destination account. This exchange is done automatically through smart contracts with minimal fees, similar to the "Hawala" system or p2p cryptocurrency exchanges, but fully automated and state-controlled.

Future

Our CBDC application has successfully launched in three countries, with plans to expand further. Some advanced features are already available, and more are on the way. Over time, we aim to make the application even more convenient, potentially phasing out physical currency in these countries, which will reduce central bank costs and enhance financial transparency and management. The unique features of CBDC will provide governments with powerful tools to combat poverty and inequality and stimulate economic development.

In the long run, CBDC could lower the costs of the financial system by creating competition for traditional commercial intermediaries like banks and payment systems.

Thanks for your attention!

如有侵权请联系:admin#unsafe.sh