This year, about 40% of the top meme coins exist on the Solana blockchain, including Smog, Dogwifhat, and Bonk. This surge can be attributed to Solana’s all-time high in March 2024, when its market cap reached $92.5 billion and its price hit $205 per SOL token.

As expected, more Solana meme coins were launched, and some experienced massive pumps. For instance, Dogwifhat (WIF) peaked with a 3000% increase in March 2024, highlighting the investment opportunities within Solana meme coins for those who had previously overlooked them. This also gave rise to the initial Solana-based non-custodial wallet - Phantom which has successfully climbed to the spot of the top three finance apps on major app stores.

We've seen Solana meme coins make people richer recently, and there's no doubt why popular Nigerian Afrobeat singer Davido once again decided to launch his own meme coin which rose to $10m in market cap after launch but crashed to $2.2m within a few hours.

Many have labeled it as a scam, and that's why we are about to unpack all the juicy details in the simplest way possible.

How It All Began

One of the most popular ways to pump a token’s price is by shilling. Shilling is a way of promoting a coin for your own speculative benefit. The idea behind it is, that the more people buy, the higher the price goes. Remember the law of demand which says “The higher the price, the lower the quantity demanded and vice versa.”

Shilling is an attempt to influence the demand of the token which will directly affect the price.

Of course, you would expect a public figure with 15.3 million followers on X to bank on his audience to shill his meme coin.

Ethically, some people frown at shilling because most times, it benefits the persons involved in the project and few others who sell off their tokens early enough as soon as it pumps, leaving the majority at a loss. While another set isn't bothered as long as it favours them.

The reason why many people may end up with a loss in such scenarios is because they are uninformed about how volatile the crypto market works but will rather jump in because of hype. Looks like what exactly happened with the $Davido meme coin.

How It Went Down

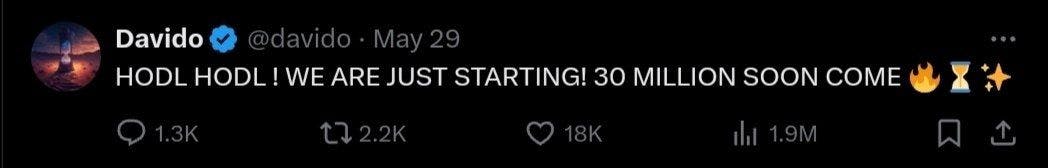

- Davido started by shilling the meme coin using 3 cryptic tweets.

- Phantom, a popular non-custodial wallet that started primarily as a Solana wallet, added its voice.

(Non-custodial wallet means you're responsible for saving your keys; once you lose access to your keys, you lose your account unlike custodial wallets like Binance, where you can reset your password).

- More shilling

- Drip announced a partnership with Davido without providing any details on what the collaboration entails (No press release or any thread on X like it's mostly done in the Web3 space to announce huge collaborations). Drip is a music streaming service platform on the Solana blockchain that allows artists to distribute their work for free.

- Solana also welcomed Davido- this sent mixed signals because many didn't want Solana to ruin their track record by affiliating with what looked like a scam.

With such 'PR,' the momentum became even bigger so it became hard for Davido’s crypto fans who are newbies to do their research (DYOR). So many trooped in to express loyalty to their “clan leader”.

- Davido appeared on a Twitter space hosted by crypto influencer Ansem to create more awareness about his token named after his recent album Timeless as Timeless Davido - $Davido.

For anyone who is knowledgeable in crypto, it will have been easy to spot during the space that Davido didn't have any idea about the project or how to sustain it. These were visible red flags. He kept on contradicting himself.

At the beginning of the space, he said:

“In the past, we did a meme coin that didn't work out. The reason I wanted to do this meme coin was to support the community; it's not about making quick cash. I wouldn't even be in this space if it was about that. 3 hours prior to this space I've been learning a lot about crypto”

Later on, he contradicted himself:

“Today was my first day really diving into this and I am really impressed with what I have seen.”

It was later uncovered that while the space was on, wallets linked to the development team of the project had started selling off their $Davido tokens.

Now, Why Is It a Problem?

- The crypto world aims to hinder centralization as much as possible. One of the ways to spot a scam project is when one wallet holds more than 4% of the total coins in circulation. This means the person has too much power so if the person decides to sell off at once, the price is affected.

Following a report from Tech Point Africa, one of the wallets was seen to hold 4% of the tokens.

“Thankfully, the blockchain is open to the public and we can see clearly that there's a wallet that holds 4% (43,254,689.74) of $DAVIDO, valued at $119,129.

In fact, the token has a total supply of almost a billion, and the top 10 holders control 225,637,134.4 tokens (22.56%) and other token holders control 77.43% (774,358,473.25) Tokens.”

-

When wallets that own huge amounts of a token (they are called whales in crypto) sell-off, it shows that they are no longer interested in the project which brings about a price drop.

-

Someone associated with the team selling off their tokens in bulk indicates a rug pull or exit scam - leaving investors at a loss. A rug pull is a malicious act in the cryptocurrency world where developers abandon a project and run away with investors' funds.

- Davido went on ahead to inform his fans of more spaces that would come up subsequently to boost the $Davido community, but at this time, so many people had observed they had been scammed and this brought about the community note attached to the tweet.

Like in every coin pump, some are ‘smart’ enough to take profit and keep moving so they don't necessarily feel scars of losses.

Davido Was Aware of the Scam

Like most scams perpetrated in the crypto space, there is always a promise to make “plenty of money” that is also fuelled with ignorance to fulfill the mission.

This will be the third time that the artist is getting involved with crypto and each time, it crashes.

In 2021, he partnered with a crypto startup- Bitsika Africa to launch the $ECHOKE fan token on the Binance Smart Chain (BSC). The project had a whitepaper and well-defined utilities like access to giveaways, NFTs, festivals, exclusive merchandise, and exclusive events for fans who own the token. However, it didn't last.

The same year, Davido shilled a meme coin RapDoge via his Twitter account (in a now-deleted tweet) shortly after announcing to his fans that he was thinking of starting a bitcoin trading company. RapDoge pumped and crashed as well. This particular incident happened within the same period that the singer was backlashed for partnering with a Ponzi scheme Racksterli which had just crashed.

In this $Davido scenario, it seems the project developers used Davido as the face of the project to get his fans to help them cash out and he was fully aware. One of the circulating screenshots from Davido’s conversation with the $Davido token creator shows that Davido was all about the money from the onset.

Following a fresh report from Mariblock, Davido was offered some amount of money to tweet about the $Davido coin after the team exposed the plan to him.

“I speak with these celebs direct, no managers or middlemen. I offered him decent money to tweet it. Gave him all the plan. Sample tweets and everything. He followed me too on IG. He launched. I had supply. We all made $ It’s all orchestrated part of marketing”.

Sahil Arora, the creator of Timeless Davido meme coin project.

The creator of the project, Sahil also stated that Davido was paid $30,000 to shill the coin while Ansem, the crypto influencer was paid $100,000 to host the space.

This May Not Be the End of the Timeless Davido Meme Coin Project

Ansem, the crypto influencer who hosted the Twitter space, took responsibility for the coin's crash. He also mentioned in a post on X that the team is working on fixing the situation.

A confused team?

Ansem also announced that one of the unfortunate events of the previous week was being scammed by Davido.

Davido and His Team Cashed Out

Transactions carried out on the blockchain are visible to everyone. If you're crypto savvy, you'll find the transactions on Solscan here 👇🏽

https://solscan.io/account/GfEoCrKFtmnGK8QYddBDo8Pnji4Gkrn1EEb6dA86CMzV#transfers

There are claims that the amount made from selling the tokens made Davido and the team behind the project almost $500,000 richer, with an unrealized profit of $207,000 still in unsold $DAVIDO tokens.

If you're selling to people on day 1, that's a sign that you're not really doing this long-term.

One Word for Solana

Retail.

Solana is often seen as the blockchain designed to onboard massively the Web2 audience (those who aren't tech savvy but use the internet every day).

A wise man on X said:

“Solana is clearly where the retail flows are, but money is getting pulled out (by malicious pump devs, memecoin insiders, celebrities, and others) at an increasing rate, and I think the rate of extraction now exceeds the $ coming in.”

As a Newbie, Should You Buy Meme Coins?

As a new entry into the crypto space, here are a few things you should bear in mind before and after buying a meme coin.

- DYOR - Do Your Own Research. Always check out the project's resources, such as the website, whitepaper, and community, if available. For $Davido, nothing much is known about the project, its security, or even the major faces behind it because no website or white paper exists.

- Examine the utilities of the project- What can I enjoy from owning this project’s tokens?

- Invest what you can lose - This is a safety precaution when it comes to risking your funds for investment.

- Always take profit

如有侵权请联系:admin#unsafe.sh