The Sift team recently had the pleasure of attending SiGMA Malta, which brought together over 25,000 attendees from across the iGaming and online gambling industry. We gleaned insightful takeaways from this event, which act as catalysts for iGaming businesses looking for new revenue protection strategies heading into 2024.

We’re fueling this excitement with the relentless pursuit of growth. As iGaming operators invest heavily in partnerships with affiliates and payment solutions, the enthusiastic push for expansion was unmistakably echoed throughout the event and continues in conversations about growth strategies among iGaming leaders. In this blog, we’ll uncover some of these key strategies and how to implement them.

Accelerating revenue and retention for VIPs

VIP players are a major source of revenue in the world of online gaming. However, they often face unnecessary troubles, like re-verification and delayed payments, due to their behavior looking a lot like traditional fraud (e.g., lots of fast transactions and multiple payment methods over a short period of time). Current fraud automation methods are often too broad and rely on fixed rules, making it difficult to tell the difference between a fraudster and a valuable player.

To tackle this issue, operators are turning to a blend of machine learning and advanced automation tools, not found in traditional fraud prevention methods. The goal is to craft dynamic VIP experiences that strike a finely tuned balance between top-notch service and mitigating fraud risks.

Minimizing promo abuse, multi-account abuse, and affiliate fraud

For many iGaming businesses, strategies aimed at fostering growth through heightened promotions and affiliate partnerships have inadvertently led to a surge in fraud rates. While historically considered an unavoidable cost of doing business online, the escalating rates have now become a pressing concern, representing a significant point of revenue leakage. In response, operators are turning to the promises of machine learning (ML) and artificial intelligence (AI), seeking enhanced insights and control over these fraud losses.

Interested in how your fraud benchmarks compare against other iGaming leaders? Check out FIBR, the definitive fraud benchmarking resource powered by Sift.

Capitalizing on alternative payment methods (APMs)

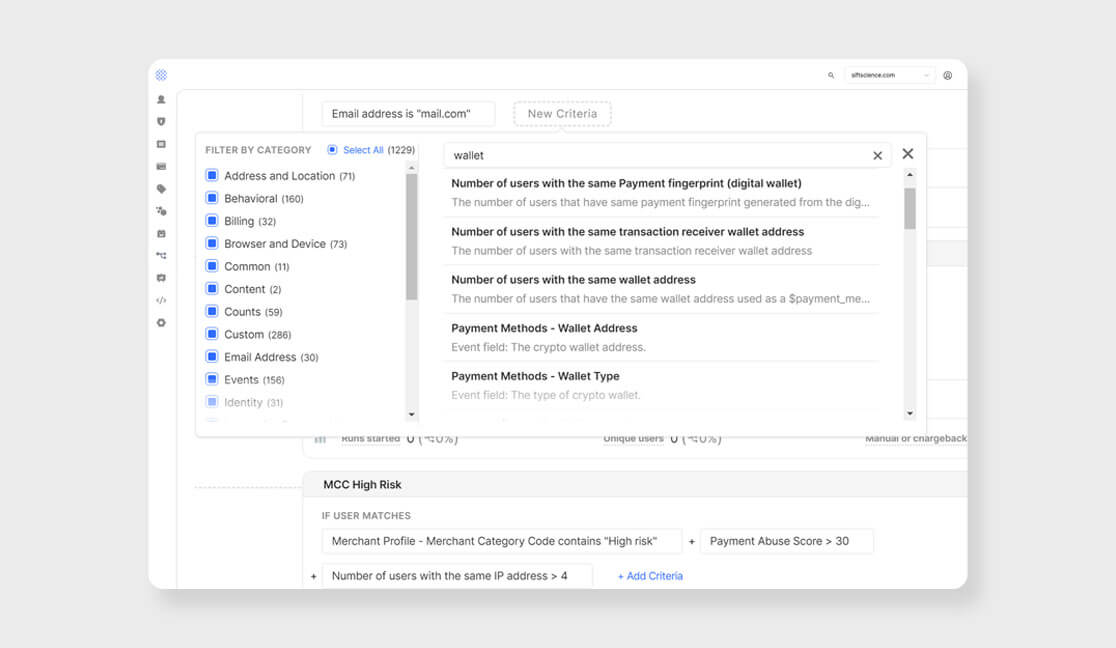

Guess what’s beating traditional payments in the world of online gaming? According to Fintech Times, 28% of players prefer using digital wallets over old-school credit cards. VIP players are leading the way, with a whopping 34% among those who bet more than seven times a week. To successfully capitalize on this trend, operators are rapidly updating their fraud strategies to include APM-specific risk signals into their fraud prevention capabilities.

Learn how these new payment methods can impact a company’s competitive advantage and ability to drive growth.

Driving the player experience

In the face of these hot button topics, driving player experiences was, and is, at the forefront of strategy discussions taking place now. This comes as no surprise as a report from GA Magazine even showed that just a 5% decrease in player churn could skyrocket profits by 25%. This rate is only set to increase alongside the rise in competition.

To help guide this topic, Sift Trust and Safety Architect Brittany Allen joined other industry leaders during a panel at SiGMA Malta to discuss finding the right balance. They explored:

- How improving player experiences must be balanced with the risk of fraud loss and potential harm to brand trust.

- Why operators need to embrace more data-driven and real-time insights to fine-tune when and how friction is applied.

- The added complexity from global fraud reach requires operators to expand their fraud network detection systems.

In the face of these challenges, traditional fraud approaches are being re-examined through the lens of innovation. Sift is at the forefront of this effort with:

- The most comprehensive global fraud network

- Customized capabilities built in partnership with iGaming leaders

- ML-based and dynamic rules-based automation

- Embedded alternative payment method (APM) fraud detection features

- Partnerships with leading KYC/AML providers

The post Top insights from SiGMA Malta to uplevel your 2024 iGaming fraud prevention strategy appeared first on Sift Blog.

*** This is a Security Bloggers Network syndicated blog from Sift Blog authored by Stephanie Trinh. Read the original post at: https://blog.sift.com/top-insights-from-sigma-malta/?utm_source=rss&utm_medium=rss&utm_campaign=top-insights-from-sigma-malta