文章探讨了金融和医疗行业面临的复杂网络安全法规要求及其对组织的影响。Seceon 提供的统一平台通过自动化合规监测、详细日志和定制报告帮助组织满足 HIPAA、PCI-DSS 等法规要求,并实时检测威胁以降低违规风险。 2025-12-15 10:35:23 Author: securityboulevard.com(查看原文) 阅读量:5 收藏

Navigating the Most Complex Regulatory Landscapes in Cybersecurity

Financial services and healthcare organizations operate under the most stringent regulatory frameworks in existence. From HIPAA and PCI-DSS to GLBA, SOX, and emerging regulations like DORA, these industries face a constant barrage of compliance requirements that demand not just checkboxes, but comprehensive, continuously monitored security programs.

The stakes couldn’t be higher. A single compliance violation can result in millions in fines, regulatory sanctions, loss of operating licenses, and irreparable damage to brand reputation. Yet traditional security approaches force organizations to choose between robust protection and compliance readiness-or worse, attempt to maintain both through fragmented, resource-intensive manual processes.

Seceon delivers a unified platform designed with compliance built in, helping healthcare and financial organizations meet requirements including HIPAA, HITECH, GDPR, PCI-DSS, and more through detailed audit logs, customizable reporting, and policy-based controls. This comprehensive approach eliminates the need to cobble together compliance evidence from disparate security tools while providing superior threat protection.

Understanding the Regulatory Burden

Healthcare: Protecting Patient Privacy and Medical Data

Healthcare organizations handle some of society’s most sensitive information. Patient health records, diagnostic images, genetic data, insurance details, and treatment histories represent valuable targets for cybercriminals while requiring extraordinary protection under federal and international law.

The HIPAA Mandate: The Health Insurance Portability and Accountability Act establishes comprehensive requirements for protecting Protected Health Information. HIPAA’s Security Rule demands administrative, physical, and technical safeguards including access controls, audit controls, integrity controls, transmission security, and more. The Privacy Rule governs how patient information can be used and disclosed, while the Breach Notification Rule requires timely reporting of security incidents affecting 500 or more individuals.

Violations carry severe penalties. The Office for Civil Rights can impose fines ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million per violation category. Criminal penalties for willful neglect can include prison sentences. Beyond financial consequences, healthcare providers face lawsuits, loss of patient trust, and potential loss of participation in Medicare and Medicaid programs.

HITECH Act Expansion: The Health Information Technology for Economic and Clinical Health Act strengthened HIPAA enforcement, extending liability to business associates and introducing mandatory breach notifications. Healthcare organizations must now ensure every vendor, contractor, and service provider handling PHI maintains adequate security controls.

The Medical Device Challenge: Modern hospitals deploy thousands of connected medical devices-infusion pumps, patient monitors, imaging equipment, surgical robots, and implantable devices like pacemakers. These IoT and smart medical devices introduce vulnerabilities, and Seceon’s platform provides device-level security monitoring to flag abnormal behavior, unauthorized access, and outdated firmware. This visibility ensures even non-traditional endpoints remain protected against evolving threats.

GDPR for Global Healthcare: European healthcare providers and any organization handling health data of EU citizens must comply with the General Data Protection Regulation. GDPR imposes strict requirements for consent, data minimization, right to erasure, breach notification within 72 hours, and substantial fines up to 4% of global annual revenue or €20 million, whichever is greater.

Financial Services: Securing the Digital Economy

Financial institutions represent the backbone of the global economy, processing trillions in daily transactions while safeguarding customer assets, personal financial information, and the integrity of financial markets. This responsibility comes with comprehensive regulatory oversight designed to ensure stability, prevent fraud, and protect consumers.

GLBA: The Foundation of Financial Privacy: The Gramm-Leach-Bliley Act requires financial institutions to explain information-sharing practices and implement comprehensive information security programs. The Safeguards Rule mandates written security plans, designation of security coordinators, regular risk assessments, vendor oversight, and employee training. Recent amendments strengthen requirements around access controls, encryption, incident response, and third-party risk management.

Penalties for GLBA violations reach $100,000 per violation for institutions, with personal fines of $10,000 and potential criminal charges for directors and officers. The reputational damage from security failures can prove even more costly—the 2017 Equifax breach resulted in a $575 million settlement, forced executive departures, and lasting brand damage.

PCI-DSS: Protecting Payment Data: The Payment Card Industry Data Security Standard governs how organizations handle credit and debit card information. All entities that store, process, or transmit cardholder data must comply with PCI-DSS requirements covering network security, access control, vulnerability management, monitoring, and security policies.

The standard includes over 300 implementation, testing, and documentation requirements across twelve core standards. Non-compliance results in fines ranging from $5,000 to $100,000 per month, increased transaction fees, and potential loss of the ability to process card payments—effectively a business death sentence for most organizations.

SOX: Financial Reporting Integrity: The Sarbanes-Oxley Act establishes accounting and compliance frameworks for publicly traded companies. Section 404 requires management to assess internal controls over financial reporting, including IT systems that process, store, and transmit financial data. Security failures that compromise financial reporting integrity can result in substantial fines and criminal charges for executives.

FFIEC: Banking Supervision: The Federal Financial Institutions Examination Council develops uniform principles and standards for federally regulated financial institutions. FFIEC guidance addresses information security, business continuity, vendor management, and incident response. The council’s Cybersecurity Assessment Tool helps institutions identify and mitigate cyber risks through comprehensive self-assessment.

NYDFS Part 500: Setting the Bar Higher: New York’s Department of Financial Services established cybersecurity requirements that many consider the most comprehensive in the United States. Part 500 mandates cybersecurity programs led by qualified Chief Information Security Officers, regular risk assessments, multifactor authentication, encryption, incident response plans, and annual compliance certifications.

Organizations failing to meet Part 500 requirements face penalties up to $250,000 per day for ongoing violations. The regulation’s extraterritorial reach means any financial institution conducting business in New York must comply, regardless of where they’re headquartered.

DORA: European Digital Resilience: The Digital Operational Resilience Act represents the EU’s comprehensive approach to operational and cyber resilience for financial entities. DORA mandates robust ICT risk management, incident reporting within specific timeframes, digital operational resilience testing, third-party risk management, and information sharing arrangements. Financial entities that fail to meet DORA standards may face fines of up to 1% of average daily global turnover.

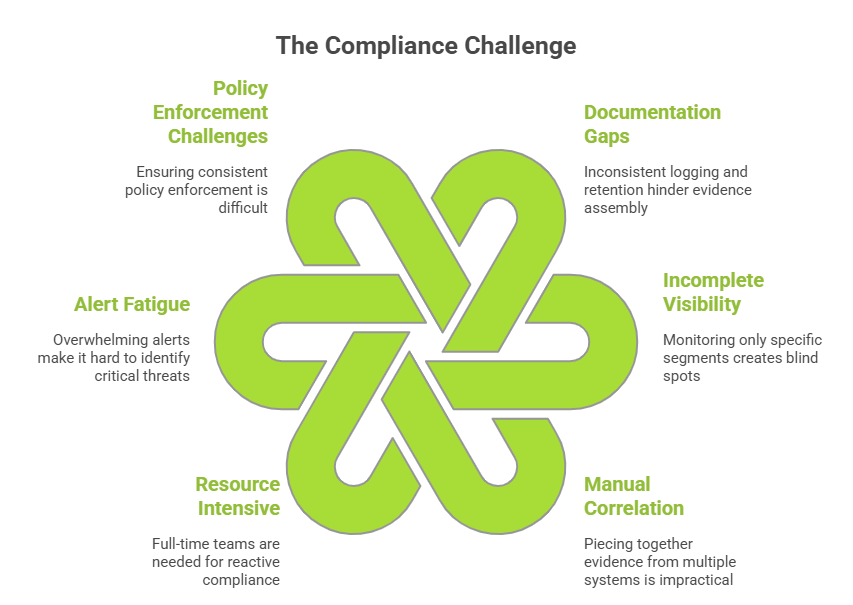

The Compliance Challenge: Why Traditional Approaches Fail

Most organizations attempt to address compliance through a combination of manual processes, spreadsheets, and point security solutions that generate relevant logs. This fragmented approach creates numerous problems that undermine both security effectiveness and compliance readiness.

Documentation Gaps: Compliance audits require comprehensive evidence demonstrating security controls operate effectively throughout the assessment period. When security data exists across multiple systems with inconsistent logging and retention, assembling this evidence becomes a months-long project involving security teams, IT operations, compliance officers, and external auditors.

Incomplete Visibility: Regulations require continuous monitoring of all systems handling sensitive data. Traditional tools that monitor only specific infrastructure segments—endpoints but not networks, on-premises but not cloud, IT but not medical devices—create blind spots that violate compliance mandates and leave organizations vulnerable to sophisticated attacks.

Manual Correlation: Proving compliance often requires correlating security events across multiple systems to demonstrate complete audit trails. When user authentication logs exist in Active Directory, network traffic data in firewall logs, database access in application logs, and cloud activity in CSP logs, manually piecing together comprehensive evidence becomes impractical at scale.

Resource Intensive: Organizations often dedicate full-time compliance teams solely to preparing for audits, responding to audit requests, and remediating findings. This reactive approach consumes resources that could be directed toward strategic security improvements while failing to provide real-time compliance visibility.

Alert Fatigue: Multiple security tools generating thousands of daily alerts overwhelm analysts, who struggle to distinguish critical threats from false positives. During compliance audits, organizations must demonstrate they appropriately investigated and responded to relevant alerts-a daunting task when alert volumes exceed analyst capacity.

Policy Enforcement Challenges: Ensuring consistent security policy enforcement across hybrid infrastructure requires configuring each security tool separately. Misconfigurations, gaps between tools, and drift over time create compliance violations that may go undetected until audit time.

The Seceon Solution: Compliance Built Into the Foundation

Seceon’s unified security platform transforms compliance from a periodic audit burden into a continuous, automated process integrated seamlessly with comprehensive threat protection. Rather than treating compliance as separate from security operations, Seceon recognizes that effective compliance management requires the same visibility, correlation, and automation capabilities that drive superior threat detection and response.

Unified Data Collection and Retention

The platform unifies IT, OT, IoMT, and cloud alerts, logs, and incident responses for faster decisions, automatically collecting security data from every infrastructure component—on-premises servers, network devices, endpoints, cloud workloads, SaaS applications, medical devices, and operational technology systems. All data flows into a centralized data lake with appropriate retention periods configured for each regulatory framework.

This comprehensive data collection eliminates gaps that plague traditional approaches. Every user authentication, network connection, database query, file access, configuration change, and security event is captured, correlated, and preserved with appropriate chain of custody for forensic analysis and compliance evidence.

Automated Compliance Monitoring and Reporting

Built-in HIPAA, FDA, HITRUST, and PCI-DSS reporting ensures audit readiness, with the platform continuously monitoring for compliance violations and generating compliance reports on-demand or on schedule. Instead of scrambling to assemble evidence when auditors arrive, organizations maintain continuous compliance posture with real-time dashboards and automated documentation.

For HIPAA compliance, Seceon automatically tracks and reports on:

- Access controls and authentication mechanisms

- Audit trails for all PHI access

- Integrity controls ensuring data hasn’t been altered

- Transmission security for PHI in transit

- Breach detection and notification timelines

- Business associate oversight and security assessments

- Risk analysis and risk management activities

For PCI-DSS, the platform provides:

- Network segmentation validation

- Cardholder data environment monitoring

- Access control and authentication reporting

- Vulnerability management tracking

- Security testing evidence

- Incident response documentation

- Compliance status dashboards

For financial regulations including GLBA, SOX, and FFIEC:

- Information security program documentation

- Risk assessment evidence

- Vendor risk management tracking

- Incident response and business continuity testing

- Security awareness training compliance

- Access control and privileged user monitoring

- Change management and configuration tracking

Real-Time Compliance Validation

Rather than discovering compliance gaps months after they occur, Seceon provides real-time alerting when policy violations are detected. If a privileged user accesses sensitive data without proper authorization, if encryption is disabled on a database containing PHI, if a medical device exhibits vulnerable firmware, or if configuration changes violate compliance policies, security teams receive immediate notification enabling rapid remediation before violations accumulate.

This proactive approach prevents the compliance debt that plagues many organizations, where accumulated violations discovered during audits require substantial remediation efforts, delayed certifications, and potential sanctions.

Intelligent Threat Detection for Compliance-Sensitive Environments

Compliance regulations ultimately exist to protect sensitive data from unauthorized access, modification, or disclosure. Seceon’s AI-driven threat detection capabilities provide the security foundation upon which compliance is built.

The platform’s advanced analytics detect sophisticated threats that compliance requirements address:

- Insider threats accessing patient records or financial data inappropriately

- Ransomware attacks targeting healthcare providers or financial institutions

- Account compromises and credential theft

- Data exfiltration attempts

- Lateral movement from compromised medical devices or payment terminals

- Advanced persistent threats targeting intellectual property or financial systems

By detecting and stopping attacks before they result in breaches, Seceon prevents the compliance violations, breach notifications, and regulatory penalties that follow security incidents.

Forensic Evidence and Chain of Custody

When security incidents occur, compliance regulations require detailed investigation, documentation, and reporting. Seceon automatically preserves forensic evidence with appropriate chain of custody, capturing all relevant security events, system logs, network traffic, and user activities surrounding incidents.

This comprehensive evidence collection supports required breach notifications, regulatory reporting, and potential legal proceedings. Rather than piecing together incomplete evidence from multiple systems, investigators access complete incident timelines with all relevant context preserved in tamper-evident storage.

Industry-Specific Capabilities

Healthcare: Beyond HIPAA Compliance

Healthcare organizations face unique security challenges that extend beyond basic HIPAA requirements. The platform provides actionable insights on healthcare attacks, insider threats, and IoMT risks while delivering continuous real-time defense for healthcare and pharma systems.

Medical Device Security: Hospital networks contain thousands of connected devices, many running outdated operating systems that can’t be patched without vendor approval. Seceon provides comprehensive IoMT security, monitoring device behavior for anomalies, detecting unauthorized access attempts, identifying vulnerable firmware versions, and integrating medical device security into overall threat detection.

Protected Health Information Tracking: The platform tracks all PHI access across systems, identifying unusual access patterns that may indicate insider threats or compromised credentials. When a user suddenly accesses significantly more patient records than normal, when records are accessed outside business hours, or when PHI is transmitted to unexpected destinations, Seceon alerts security teams for investigation.

Research and Clinical Trial Protection: Pharmaceutical companies and research institutions face threats targeting valuable intellectual property including drug formulations, clinical trial data, and research methodologies. Seceon provides comprehensive protection for research environments while maintaining compliance with FDA regulations, HITRUST requirements, and GxP standards.

Telehealth Security: The explosion of telehealth services creates new attack surfaces requiring specialized monitoring. Seceon secures video consultation platforms, remote patient monitoring systems, and patient portals while ensuring HIPAA compliance for these digital health channels.

Financial Services: Multi-Framework Compliance

Financial services organizations can ensure compliance with minimal effort through automated reporting and audits, addressing the complex web of overlapping regulations that govern banking, insurance, payment processing, and investment services.

Transaction Monitoring: Real-time monitoring of financial transactions identifies anomalies that may indicate fraud, money laundering, or unauthorized access. The platform correlates transaction data with security events, user behavior, and threat intelligence to detect sophisticated financial crimes.

Trading Platform Security: Securities firms and cryptocurrency exchanges require specialized monitoring for high-frequency trading systems, ensuring security controls don’t introduce latency while detecting threats targeting trading algorithms, market data feeds, and order execution systems.

Anti-Money Laundering Integration: While not replacing dedicated AML systems, Seceon’s security monitoring integrates with AML platforms to provide additional context for suspicious activity investigations, correlating security events with transaction patterns and customer behavior.

Third-Party Risk Management: Financial institutions rely on hundreds of vendors, service providers, and business partners. Seceon monitors third-party connections, detects unusual access patterns from partner networks, and provides evidence of vendor security oversight required by regulations.

Cloud Financial Services: As financial institutions migrate applications to cloud platforms, maintaining compliance in shared responsibility environments becomes critical. Seceon provides unified monitoring across on-premises core banking systems and cloud-based customer applications, ensuring consistent security and compliance coverage.

The ROI of Compliance-Ready Security

Organizations implementing Seceon’s platform achieve substantial financial benefits beyond avoiding regulatory penalties.

Reduced Compliance Costs: Organizations report 68% cost reduction and proactive ROI through AI-driven automation. By automating compliance evidence collection, monitoring, and reporting, organizations reduce or eliminate dedicated compliance teams, decrease external audit costs through improved audit readiness, and accelerate certification timelines.

A typical mid-sized healthcare system or regional bank spends $2-5 million annually on compliance-related activities including staff time, external assessments, audit preparation, and remediation. Seceon’s automated approach reduces these costs by 60-75%, redirecting resources toward strategic initiatives while improving compliance posture.

Faster Incident Response: Comprehensive visibility and automated response capabilities dramatically reduce the time required to detect, investigate, and remediate security incidents. The platform delivers 99%+ detection accuracy and faster remediation, preventing incidents from escalating into reportable breaches that trigger regulatory notifications, investigations, and potential penalties.

Avoided Breach Costs: Healthcare data breaches average $10.93 million—nearly three times the cross-industry average. Financial services breaches average $6.08 million. A single prevented breach delivers immediate ROI while avoiding the regulatory scrutiny, reputation damage, and customer attrition that follow security incidents.

Audit Efficiency: Organizations report 80-90% reductions in audit preparation time. Instead of spending months assembling documentation, compliance teams generate comprehensive reports in minutes, accelerating certification processes and reducing external audit costs.

Competitive Advantage: Strong compliance posture and security certifications differentiate organizations in competitive markets. Healthcare providers win contracts with accountable care organizations and health insurers who require robust security programs. Financial institutions attract customers concerned about data protection and meet partnership requirements from larger institutions.

Real-World Success: Healthcare and Finance

Large Hospital System: A 12-hospital healthcare network replaced seven separate security products with Seceon’s unified platform. The organization achieved continuous HIPAA compliance, detected and contained a ransomware attack targeting medical records before encryption occurred, reduced compliance staff requirements by 65%, and passed Joint Commission and HHS audits with zero findings for the first time in five years.

Regional Bank: A community bank holding company consolidated security monitoring across 45 branches, core banking systems, and customer-facing digital channels. The bank maintained continuous compliance with GLBA, PCI-DSS, and NYDFS Part 500, detected an insider threat accessing customer accounts inappropriately, reduced annual compliance costs by $2.1 million, and completed regulatory examinations 70% faster than previous years.

Pharmaceutical Research: A biotech firm securing clinical trial data across global research sites unified security monitoring for research labs, manufacturing facilities, and cloud-based collaboration platforms. The organization maintained FDA compliance, protected intellectual property worth billions in development costs, detected advanced persistent threat activity targeting research data, and accelerated drug development timelines by eliminating security-related delays.

The Future of Compliance: From Burden to Enabler

Regulatory requirements will only increase as cyber threats evolve and data privacy concerns intensify. Organizations that view compliance as merely a checkbox exercise will struggle under increasing burdens while remaining vulnerable to sophisticated attacks.

Forward-thinking healthcare providers and financial institutions recognize that compliance and security are inseparable. The same visibility, correlation, and response capabilities that detect advanced threats also generate compliance evidence. The same unified platform that protects patient health information and financial data also demonstrates regulatory adherence.

Seceon’s approach transforms compliance from periodic audit preparation into continuous assurance integrated seamlessly with comprehensive threat protection. Rather than choosing between security effectiveness and compliance readiness, organizations achieve both through a single unified platform.

Take the Next Step

Healthcare and financial services organizations deserve security solutions purpose-built for their unique challenges. Seceon delivers the comprehensive protection, compliance readiness, and operational efficiency that enables digital transformation while meeting the most stringent regulatory requirements.

Discover how Seceon’s unified platform can transform your compliance program from burden to strategic advantage. Contact our team for a personalized assessment of your compliance challenges and demonstration of how Seceon addresses your specific regulatory requirements.

Your patients and customers trust you with their most sensitive information. Trust Seceon to help you protect it while demonstrating compliance with confidence.

About Seceon

Seceon provides comprehensive, AI-powered security operations platforms purpose-built for highly regulated industries including healthcare and financial services. The company’s unified platform delivers superior threat protection while automating compliance evidence collection, monitoring, and reporting for frameworks including HIPAA, PCI-DSS, GLBA, SOX, GDPR, and emerging regulations. Seceon’s platform is trusted by healthcare providers, hospitals, pharmaceutical companies, banks, credit unions, payment processors, and insurance companies worldwide to protect sensitive data while demonstrating regulatory compliance efficiently.

The post Compliance-Ready Cybersecurity for Finance and Healthcare: The Seceon Advantage appeared first on Seceon Inc.

*** This is a Security Bloggers Network syndicated blog from Seceon Inc authored by Anamika Pandey. Read the original post at: https://seceon.com/compliance-ready-cybersecurity-for-finance-and-healthcare-the-seceon-advantage/

如有侵权请联系:admin#unsafe.sh